Finding rich tales of migration, tradition, community and endurance, Lucy Shrimpton discovers that independent delis and diners are the essence of NYC. Go before they’re gone.

Finding rich tales of migration, tradition, community and endurance, Lucy Shrimpton discovers that independent delis and diners are the essence of NYC. Go before they’re gone.

On a corner plot of Little West 12th Street, right beneath the High Line where once the railroad clattered, a bright neon light has been urging the district’s meatpackers into Hector’s Café & Diner for frill-free coffee since 1949. The frontage is cinematic, in ketchup and mustard tones, though it’s the interior that leant Scorsese his diner scenes for Taxi Driver.

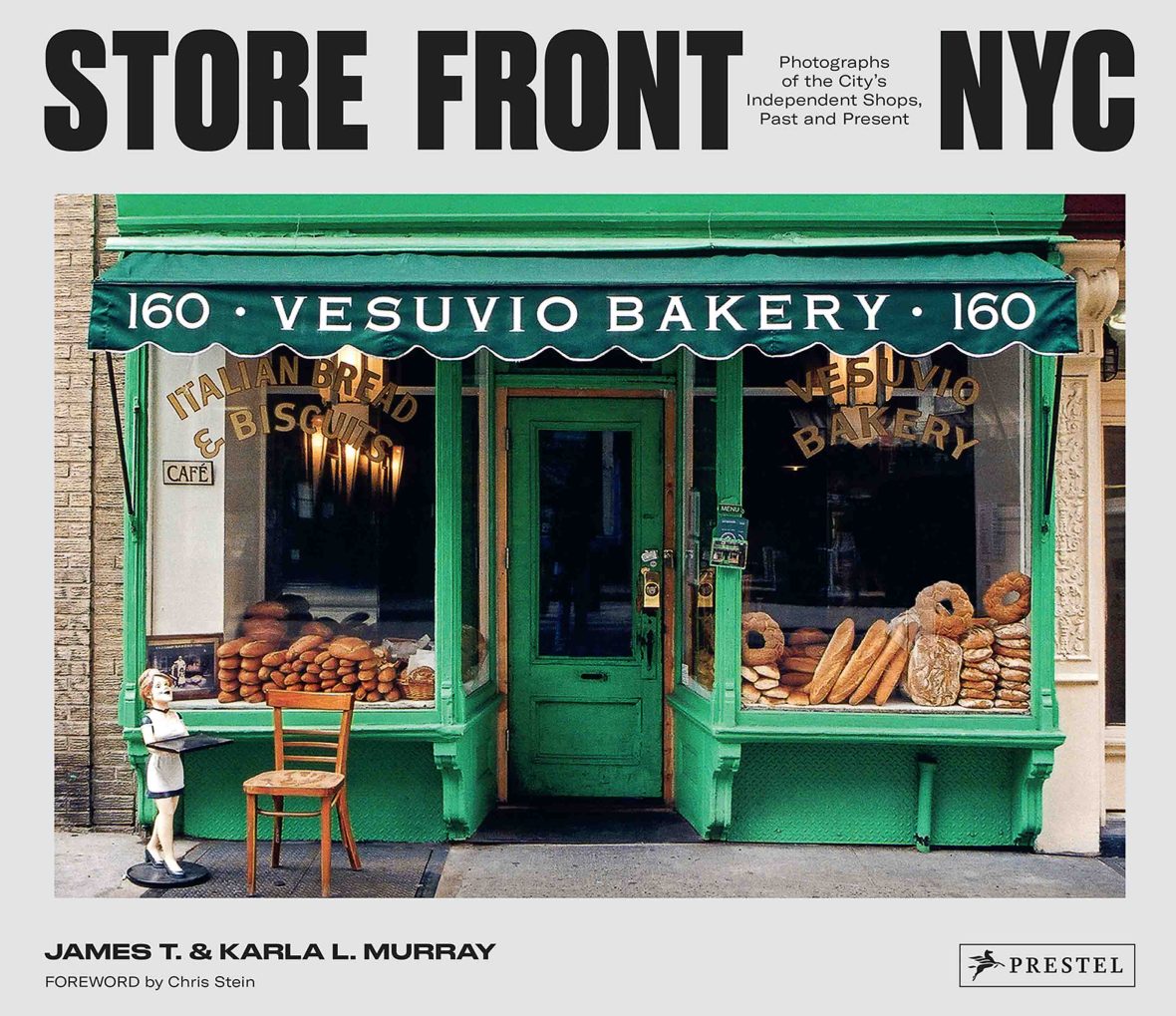

It’s a diner I found neither by chance nor guidebook. On my first-ever trip to New York City, 30 years in the yearning, and with too few days to explore, I found Hector’s in the pages of Store Front NYC, a weighty and wordless coffee-table book by husband-and-wife photography duo James and Karla Murray.

These mom-and-pop addresses are just as integral to the city’s fabric as the Empire State Building, Brooklyn Bridge, or Times Square. And it was in these pages I found my shortcut to the history of NYC’s neighborhood communities—in photographic form.

Once inside Hector’s, with its mirrored pillars, TV on, and suspended counter stools where customers watch their breakfast eggs sizzle, it’s easy to see why it was a perfect fit for James and Karla’s selection. And with all the openness and spirit you somehow expect from New Yorkers, the photographers explain to me where their affection for old-school addresses began—for context, they started the project so long ago, they were using 35mm Kodak film bought from a local candy store.

“We really fell in love with store fronts’ hand painted lettering, neon signs, and window displays,” Karla says passionately, “so in the book, we chose only to include the exterior of each store. For us, it’s the single most important thing to attract someone’s attention. We wanted to make the store front the hero of the story.”

“Only around half of the stores featured in Store Fronts NYC are still open for business. That’s why we included the address for each store so that people actually go there.”

- Karla Murray, co-author, Store Front NYC

“The term ‘mom-and-pop’ stores is a colloquial term for small and independently owned family businesses started by a Mom and Pop—the so-called proprietors—who generally ran the business and lived above the store,” says born-and-bred Karla, sharing with me her unending knowledge of immigrant-founded stores from the Lower East Side to the Upper West Side and beyond.

“They were neighborhood stores that provided a foothold for new immigrants… a familiar place where your language is spoken and with food traditions and culture present”. Places where, as I’m finding out for myself, photos of the owner’s ancestors opening up shop are often still pinned behind the counter.

What began as an aesthetically driven project soon took on more urgency as James and Karla began to notice that some stores were disappearing amid impossible rent renewals, modernization and gentrification.

“Sadly, only around half of the stores featured in Store Fronts NYC are still open for business,” says Karla. “That’s why we included the address for each store so that people actually go there.”

Not just important for the preservation of cultural identity, “they’re also community lifelines,” Karla says. She sighs, recalling their now-gone neighborhood café Cup & Saucer. And gone with it the days the proprietor would see them coming across the street and start getting their drinks ready before they’d even stepped inside. “He knew just the way we liked our coffees,” she tells me.

“We don’t want to make New York like a place that never changes… I mean New York is known for its change,” says Karla. “But if a business like that closes, the neighborhood loses the very charm of why we’re attracted to it in the first place.”

Caffe Reggio, Greenwich Village, for cappuccino and cheesecake

If a 97-year-long timelapse had been set up in this neighborhood café, little change would be detected over the years, its Italian Renaissance artworks still setting a boho tone. “It’s like having a coffee in a museum,” says owner Fabrizio Cavallacci.

Fleetingly in the frame, you might spy villagers Bob Dylan and Jack Kerouac at its marble-topped tables, but permanently in situ is the monumental and richly embellished antique espresso machine. Barber-turned-barista Domenico Parisi’s decision to ship it across from the homeland in the ‘20s might have cost him every buck he owned, but it did earn him the claim to froth-fame: ‘First cappuccino served in the US’.

More than just a coffee house, come later too for espresso martinis, ravioli alla vodka, and Fabrizio’s pudding pick: Tiramisu.

Caffe Reggio, 119 MacDougal Street NY, 1001

More info: caffereggio.com

When the New York Times described it as an “authentic taste of an inauthentic past,” it perfectly synopsized the merging of food traditions when cultures collide post-immigration.

Faicco’s Deli, Greenwich Village, for homemade mozzarella and loaded sub takeouts

Seeking a taste of the homeland over a century ago, newly immigrated Neapolitan Eduardo Faicco got more than he bargained for when he found a splinter in his sausage meat at his local store. Ranting a pledge to put the vendor out of business, the place he set up in spite thrives to this day, his descendants still at the helm.

Beneath garlands of Italian tricolor, grab a ticket and get in line for warm arancini (deep-fried risotto balls) and soppressata (Italian salume) and, while you wait, watch the hive of aproned staff wield their cheese-wires—and weigh (splinter-free) sausage to order.

Faicco’s, 260 Bleecker Street, NY 10014

More info: instagram.com/faiccosnyc

B&H Dairy, East Village, for fresh challah bread

Everything and nothing changes at B&H. From Jewish ownership in 1938 into the hands of Polish-Catholic Ola and her partner Egyptian-Muslim Fawzi, it both upholds the traditions of its founders and reflects the East Village’s diverse spirit. It’s also an address for eavesdroppers: “It’s so narrow that everyone talks to each other the whole time,” says James. “Someone said to me it was like the most New York City conversation they’d ever had.”

After vegetarian Borscht soup, blueberry blintzes, or challah French toast, head on to Search and Destroy vintage store (also featured in Store Front NYC) around the block; out with your throwaway Empire State souvenir and in with your throwback punk curios.

B&H Dairy, 127 2nd Avenue, NY 10003

More info: instagram.com/bandhdairy

Wo Hop 17, Chinatown, for chop suey and egg foo young (Chinese omelette)

On the heavily mirrored basement level of technicolor Mott Street, where Chinese immigrants have been settling since the 1850s, customers are loyal. Against a blanket backdrop of famous faces collaging the walls, diners whose families have been coming for fast and frill-free food for generations—now even for Year-Of-The-Dragon merchandise t-shirts—squish in together.

When the New York Times described it as an “authentic taste of an inauthentic past,” it perfectly synopsized the merging of food traditions when cultures collide post-immigration. After lobster-Cantonese-style, chow fun, or Won Ton soup, try a sweet treat from the Original Chinatown Ice Cream Factory on Bayard Street; legend attributes the invention of ice cream to the Chinese during the Tang Dynasty. (Don’t tell the Italians).

Wo Hop, 17 Mott Street, NY 10013

More info: wohop17.com

Russ & Daughters, Lower East Side, for lox and schmear on boiled bagels

For the pure pleasure of capturing its distinctive piscatorial signage, James and Karla have come repeatedly with cameras “from snowy days to wet ones for the neon reflected in the sidewalk… kind-of like our Monet’s Haystacks”.

Founded by Polish immigrant Joel Russ in 1914 and originally starting off as a pushcart, this busy deli now in the hands of the fourth gen is said to be not only the first to coin the term ‘appetizers,’ but also to stamp the business name with the feminist appendage ‘… & Daughters’, referring to the women you’ll see on the walls in black-and-white photos.

Come for matzo ball soup, caviar and every smoked fish dish under the sun. And if it leaves you wanting more, Russ & Daughters’ on-trend dine-in concept a few blocks away on Orchard Street has a Michelin Bib Gourmand.

Russ & Daughters, 179 East Houston Street, NY 10002

More info: russanddaughters.com

“I’ve been helping from when I was in junior high school. I’m now in my 40s and it’s still a pleasure to serve the Upper West Side for three generations.”

- Richie Zingone, Zingone Brothers

Lexington Candy Shop, Upper East Side, for shakes and floats

Spinny stools and leatherette booths provide all the time-warp feels of this landmark luncheonette serving sugar-rush slurps to the neighborhood ever since Greek grandpop opened up shop in 1925. Locals come for constancy in an inconstant city, as much for the staples—tuna melts, clubs, and an iconic NYC Egg Cream of homemade choc syrup, cold milk and seltzer—as for the staff, many of whom are still behind the counter year-on-year.

Though Springsteen has been stopping by since the early 90s, the real Boss is third-gen John Philis; that’s him behind the counter in pristine-white workwear, tie and cap. “I came to help my folks out in 1980… I figured for a couple of years,” he tells me. “It’s now 2024 and I’m still here. I liked it.”

Lexington Candy Shop, 1226 Lexington Avenue, NY 10028

More info: lexingtoncandyshop.com

Zingone Brothers, Upper West Side, for market-fresh fruit in a fast-food city

From the mouths of the Zingones who work here on the fringes of Central Park to the shoppers who’ve been coming for over 50 years for friendliness, familiarity and to cherry-pick their hardware and produce, it’s first-name terms here. Even when those mouths were swaddled with face masks, the Zingones threw a lifeline delivering essentials from the packed-to-the-rafters, tin-ceilinged groceteria to homes in the ‘hood.

Domenico and Vincenzo’s faded photographs endure, their dialect still rings in the ears of descendants 100 years on, and a commitment to blood ties flows on: “I’ve been helping from when I was in junior high school,” says Richie Zingone, with pride. “I’m now in my 40s and it’s still a pleasure to serve the Upper West Side for three generations.”

Zingone Bros, 471 Columbus Avenue, NY 10024

More info: zingonebrothersny.com

While these stores may be disappearing, James and Karla—who describe themselves as “very positive people by nature”—seem certain that mom-and-pops are starting to be seen as vital again.

“To us, the most important thing is that people actually go [inside the store],” says Karla, “so that the businesses stay in business for many, many more years to come.”

Go before they’re gone.

You can also follow James and Karla Murray at instagram.com/jamesandkarla

****

Adventure.com strives to be a low-emissions travel publication. We are powered by, but editorially independent of, Intrepid Travel, the world’s largest travel B Corp, who help ensure Adventure.com maintains high standards of sustainability in our work and activities. You can visit our sustainability page or read our Contributor Impact Guidelines for more information.

Lucy Shrimpton is a Bristol-based freelance writer who writes about short-radius travel in the UK, France and The Netherlands, with an occasional story further afield. Off-piste childhood vacations, studying languages, and a curiosity to understand where people call 'home' contribute to Lucy’s interest in writing about place, and shining a light on social histories, regeneration, the arts, and walking routes. Lucy is also a proofreader, volunteer and French-to-English translator.

Can't find what you're looking for? Try using these tags: